In the ever-evolving world of gaming, game developers and studios should understand the intricacies of different markets around the world. The more you know about local consumer behaviors and needs, the more you increase your chance for global growth. Emerging as a leading hub within the video game industry, the Singaporean gaming market offers increasingly lucrative potential for game developers to expand their reach to a tech-savvy audience, and their revenue within a robust gaming ecosystem.

“Potential of Singapore gaming market” quoted by Adrian Eng, Xsolla Country Manager of Singapore.

“The Singapore gaming market is a trove of growth potential and opportunity, fueled by innovation and a robust payments landscape that are propelling the industry towards a new era. We recognize the limitless possibilities and are helping to carve a path for our partners in this expanding horizon.”

To make the most of this opportunity and level up your gaming business’ success in Singapore, Xsolla’s global gaming experts have created this guide to game launch in the Singaporean market that will help you understand vital details about the region including: its payment landscape, its most popular local payment methods, and how to leverage these to craft your strategy for entering the market

Singapore’s Payment Landscape

There are more than 1.5 billion tech savvy gamers in the Asia-Pacific region, and Singapore is on the trajectory to become the area’s, and ultimately the world’s, gaming capital. This opens up a new avenue of opportunity for developers who want to launch their games in a receptive, welcoming market. From its explosive growth to its steady transition into a cashless society, here are some key factors that highlight the evolving payment landscape in Singapore:

HIGH GROWTH POTENTIAL

With the exponential increase of gamers in the region driven by advancing tech and shifting customer preferences, Singapore’s payment industry has witnessed a rapid evolution. As a tech-embracing nation, Singaporeans have readily adopted digital payment methods, with approximately 40% of the population transitioning to online payments in the last few years.

Singapore’s market is characterized by its innovative payments strategies. Efforts from the government, financial authorities, and banks have joined forces to ensure a robust and almost fully banked population, an education and understanding of electronic payments, and an evolving payments infrastructure that all encourage consumers to utilize digital payment methods for their day-to-day transactions. This has resulted in a rise of contactless payments, a surge in credit card usage, and the increased use of e-wallets.

GLOBAL LEADER IN DIGITIZING PAYMENTS

Driven by the increasing adoption of e-commerce and mobile payments, as well as the surge in contactless payment methods, Singapore’s digital payments market is currently experiencing a surge in growth. This trend is only further accelerated by Singapore’s government’s and financial authorities’ initiatives to promote digital payments in an effort to create an inclusive and innovative e-payments society.

Due to the convenient and secure solutions that enable seamless digital transactions, the rise of digital wallets and mobile payment apps like PayPal, Venmo, and Cash App have significantly contributed to the surge in popularity of digital payments. Other factors, like the growth of fintech startups and the integration of blockchain technology into payment systems, have also contributed to this region’s digitized payments market.

HIGH BANK ACCOUNT PENETRATION

Singapore ranks amongst the countries leading the rest of the world in its residents’ openness towards digital banking alternatives. With a remarkable rate of financial inclusion, Singapore stands out for its impressive percentage of banked individuals, surpassing 98% of adult residents who possess bank accounts, according to the Monetary Authority of Singapore (MAS).

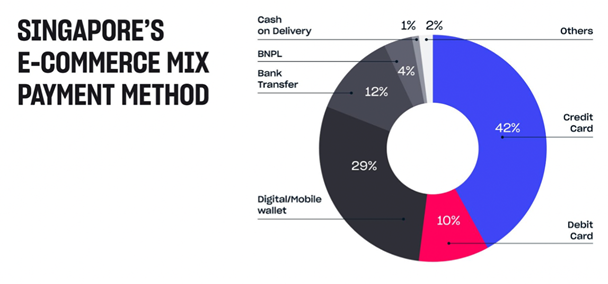

This pervasive adoption of banking services significantly influences the prominence of card-based payments. And when it comes to payment methods, credit cards reign as the top payment method, preferred for their convenience and ability to provide gamers with a secure payment experience.

GAMER SPENDING HABITS

Singapore’s gaming community exhibits a strong inclination toward investing in in-game purchases, mirroring the global gaming population that engages in video games not only for entertainment but also as a means of social interaction and stress relief. Leveraging its game-focused audience of avid spenders, Singapore presents a significant opportunity to bolster your game’s global revenue strategy.

“Singapore’s gaming community offers a thriving platform for global revenue strategy. As Xsolla’s Country Manager of Singapore, I witness the vast potential this market holds for developers and publishers seeking to tap into a game-focused audience of avid spenders. Together, we forge a partnership that leverages the gaming ecosystem’s social engagement to unlock success in the industry.”

“Singapore’s gaming community offers a thriving platform for global revenue strategy. As Xsolla’s Country Manager of Singapore, I witness the vast potential this market holds for developers and publishers seeking to tap into a game-focused audience of avid spenders. Together, we forge a partnership that leverages the gaming ecosystem’s social engagement to unlock success in the industry.”

The country’s lower Consumer Price Index also reflects its stable economic condition and reduced inflation, creating a favorable environment for consumer spending on mobile games, in-game purchases, physical and digital game copies, portable game consoles, and more. With a positive economic outlook and a highly developed internet infrastructure, Singapore’s gaming appetite is expected to remain robust for the foreseeable future.

Payment Options & Gamer Preferences

Unlocking the full potential of entering the Singaporean gaming market requires embracing and adopting local payment methods. By incorporating localized payment options, you can eliminate barriers between players and your game and offer a frictionless payment experience as they make in-game purchases. So, what are the most common payment methods used in Singapore and which of these should you focus your payments strategies on?

Unlocking the full potential of entering the Singaporean gaming market requires embracing and adopting local payment methods. By incorporating localized payment options, you can eliminate barriers between players and your game and offer a frictionless payment experience as they make in-game purchases. So, what are the most common payment methods used in Singapore and which of these should you focus your payments strategies on?

CREDIT CARDS

Unsurprisingly, credit cards are the most preferred payment method with widespread adoption among Singaporeans. We attribute the universal usage of cards for gaming-related payments to Singapore’s highly banked population. Visa cards lead the way, accounting for 34% of all card transactions in e-commerce, followed closely by Nets at 33% and Mastercard at 26%. This wide acceptance of various card brands provides game developers with a vast potential customer base.

E-WALLETS

Digital wallets have gained significant traction in Singapore, gradually catching up to traditional payment methods like credit cards and cash. Market research predicts that digital wallets will overtake credit cards by 2024, capturing nearly one-third of the market share – and Singapore ranks among the top three e-wallet markets in the Asia-Pacific region.

There are currently more than ten local digital wallets in Singapore. The most commonly used are PayNow, GrabPay, DBS Paylah, FavePay, and Singtel Dash – with PayNow and GrabPay backed by local banks and super-apps, giving them an advantage over their competitors. The popularity of e-wallets can be attributed to ease of use and promotional benefits, especially since consumers can do any financial transaction via a smartphone application.

“Local payment methods Xsolla provide in Singapore” quoted by Adrian Eng, Xsolla Country Manager of Singapore

“Embracing local payment methods is paramount for game industry success in Singapore. Xsolla leads the way by providing seamless integration of popular options like PayNow, GrabPay, DBS Paylah, FavePay, and Singtel Dash, unlocking the full potential of in-game purchases for developers and players alike.”

FUNDS TRANSFER

FUNDS TRANSFER

Singapore has well-established real-time payment systems that enable seamless inter-bank fund transfers. Platforms like eNETS, operated by NETS, a consortium of Singapore’s top three largest banks (DBS, UOB, and OCBC), facilitate secure and efficient transfers for both consumers and businesses. This capability opens up opportunities for game developers to offer diverse payment options to their customers, catering to their preferences.

Strategies for Success in Singapore

Since entering a new market requires a well-defined strategy to capture the attention and loyalty of gamers, here are some things to keep in mind to help you position your game for success in the Singaporean gaming market:

● Localization. Games that resonate with local culture and language have a higher chance of success. By adapting your game to the preferences of the Singaporean audience, you can create a more immersive and engaging gaming experience.

● Adopt Local Payment Methods. Singapore boasts a diverse range of preferred payment methods. By accounting for the region’s popularity for credit card, e-wallet, and funds transfer payments, you can offer gamers convenient and seamless payment experiences.

● Stay Updated on Market Trends. The gaming industry is dynamic, and staying updated with market trends is essential for success. By staying attuned to market trends, you can adapt your strategies, introduce new features, and stay ahead of the game.

With a combination of favorable economic conditions and a thriving gaming community, Singapore is a valuable market with a trove of opportunities to tap into. Xsolla’s expertise and comprehensive payment solutions enable seamless integration with the local payment landscape, empowering game developers to capture a larger audience and maximize their revenue growth.

From supporting localization and distribution to publishing and legal, including paying taxes and global compliance with privacy laws, we’re consistently working to expand our payments portfolio, empowering you to enable Singapore’s popular local payment methods and turn more global gamers into customers. And with our deep understanding of the local landscape, we can help game developers navigate this dynamic payment ecosystem seamlessly.

Whether you’re a current Xsolla partner or want to accelerate your game’s global reach, start exploring Xsolla’s range of payments solutions by visiting our website xsolla.com. Or, contact an expert from our team and set up a time to discuss how we can help you turn Singapore into a cornerstone of your global growth strategy.