APAC telcos add a collective USD 5.9 billion in incremental revenue in Q2 2023 from Q2 2022

Driven by continued growth and a collective increase in revenue, telecommunications revenue in Asia Pacific (APAC) has surpassed USD 150 billion in Q2 2023. However, Q2 2023 currently exhibits the lowest growth rate compared to the previous five quarters, at 4.1 percent YoY (year-on-year), indicating a slowdown in revenue growth for APAC telcos (refer to Exhibit 1).

Exhibit 1: Overall performance of APAC telcos in Q2 2023

Source: Telco financials, Twimbit analysis

Source: Telco financials, Twimbit analysis

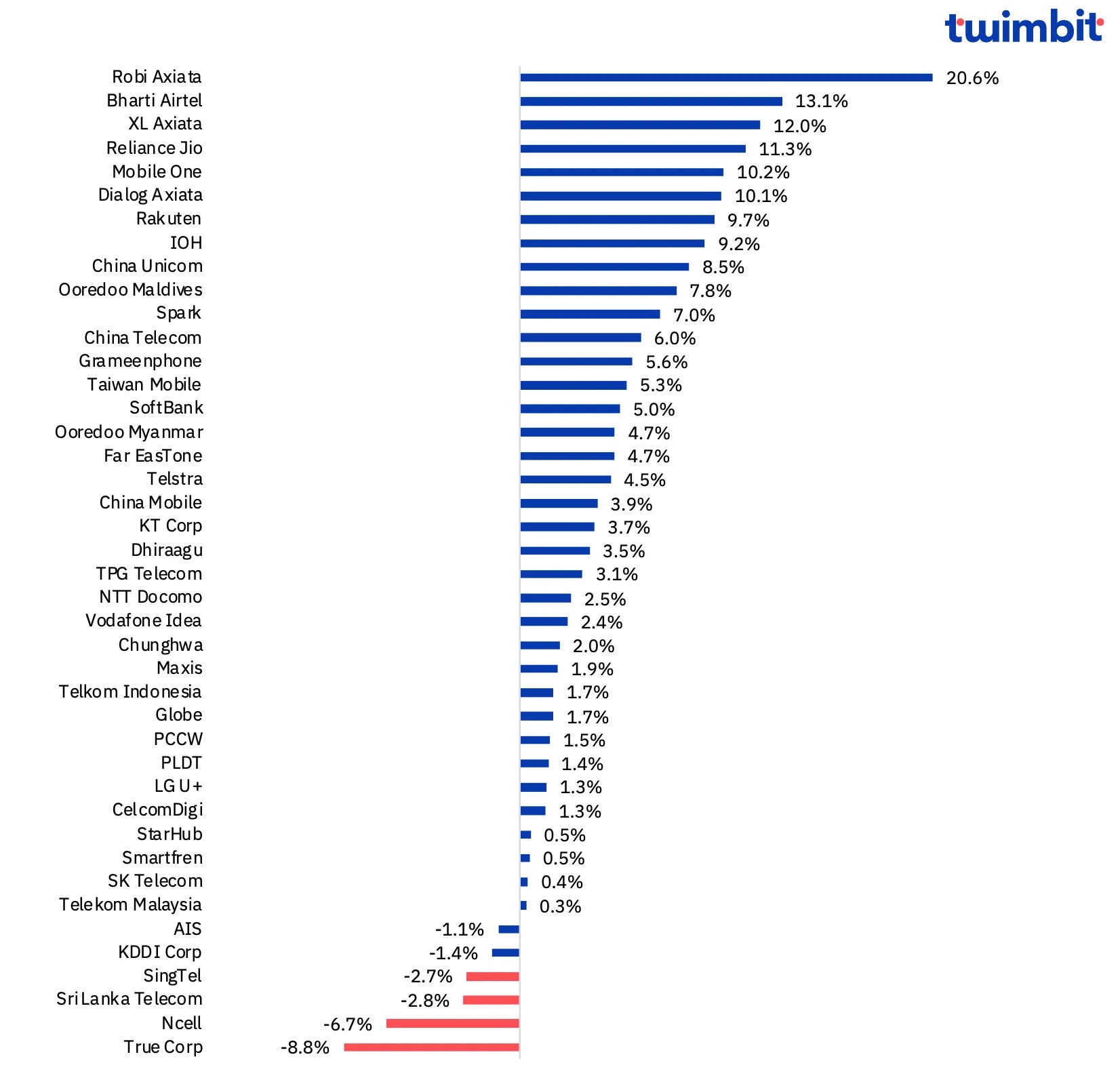

36 of the 42 telcos experience positive YoY revenue growth in Q2 2023

Six of the 42 telcos in the Asia Pacific achieved double-digit revenue growth (refer to Exhibit 2) in Q2 2023, with Robi Axiata leading at a 20.6 percent YoY growth rate, totalling ~USD 237.2 million (BDT 25.4 billion). This growth by Robi Axiata was fuelled by the increase in its data revenue by ~30 percent YoY.

And despite the prevailing high competition intensity, the top three Indian telcos achieved a 10% YoY revenue growth rate in Q2 2023. Meanwhile, XL Axiata and Indosat Ooredoo Hutchison (IOH) in Indonesia reported significant revenue growth in Q2 2023, which is expected to continue consistently throughout 2023.

Exhibit 2: Revenue trends (% change) for APAC telcos (YoY basis), Q2 2023

Source: Telco financials, Twimbit analysis

Source: Telco financials, Twimbit analysis

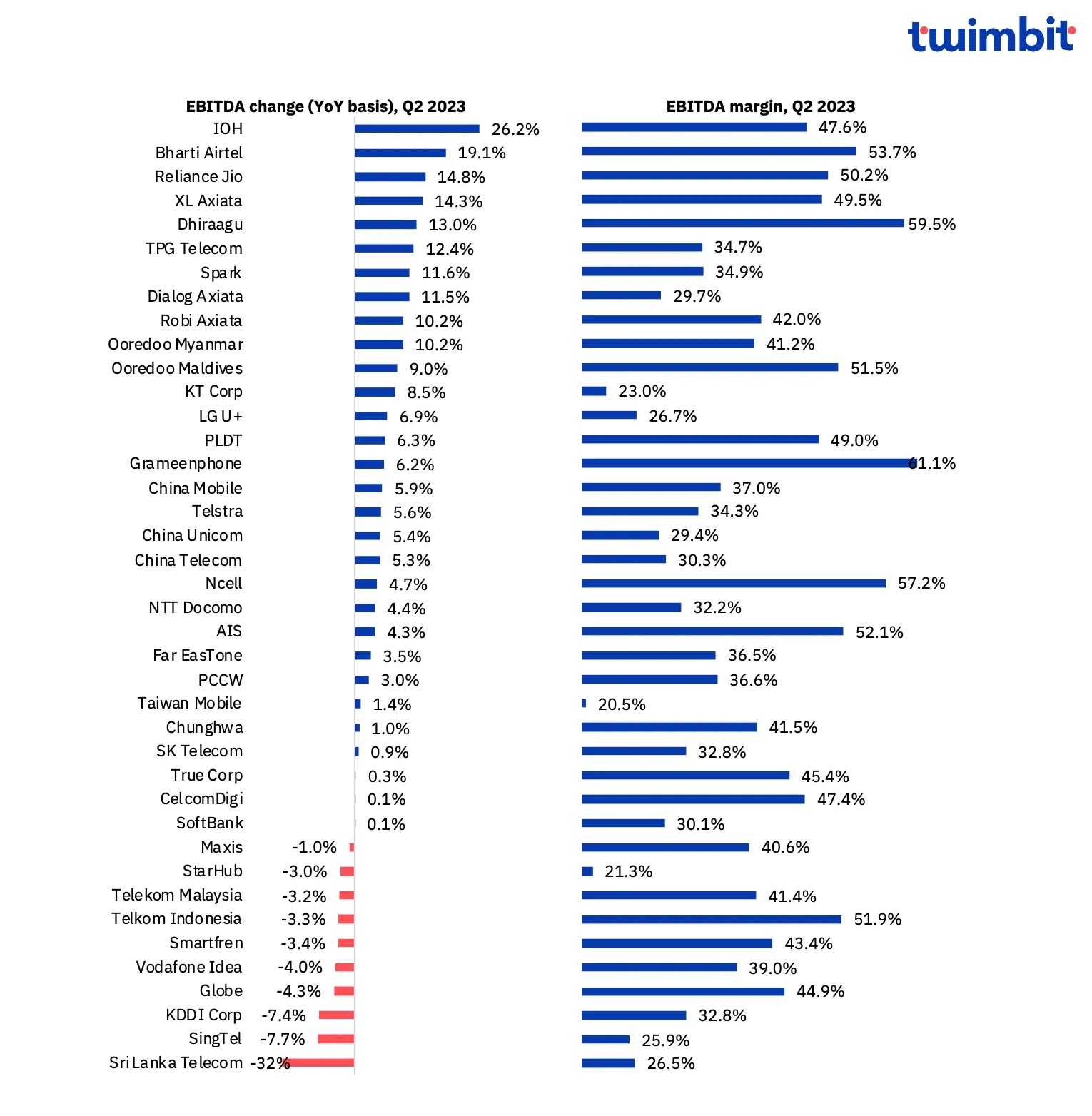

APAC telcos record a new EBITDA margin at 34.7% in Q2 2023

Telcos across the Asia Pacific achieved the highest average EBITDA margin (34.7 percent) compared to the previous 5 quarters, with 32 of the 42 telcos reporting positive changes in EBITDA (refer to Exhibit 3).

Indosat Ooredoo Hutchison (IOH) recorded the highest EBITDA increase by 26.2 percent YoY, reaching ~USD 677.9 million (IDR 6.1 trillion). This increase was driven by cost optimization efforts and the festive Lebaran season, which had a positive impact on the telco’s revenue and EBITDA growth.

In contrast, Sri Lanka Telecom’s EBITDA declined by 32 percent YoY to ~USD 22.3 million (LKR 6.9 billion) in Q2 2023 due to a 15.1 percent increase in group operating expenditure (OPEX).

“Overall, the trends that the telecom industry have achieved in Q2 2023 signify a more focused commitment towards improving cost efficiency and reducing OPEX,” – Aryaman Seth (Research Analyst, Twimbit)

Exhibit 3: EBITDA and EBITDA margin trends for APAC telcos (YoY basis), Q2 2023

Source: Telco financials, Twimbit analysis

Source: Telco financials, Twimbit analysis

Twimbit clients can read more in “APAC Telcos Update Q2 2023”.

Tinggalkan Balasan